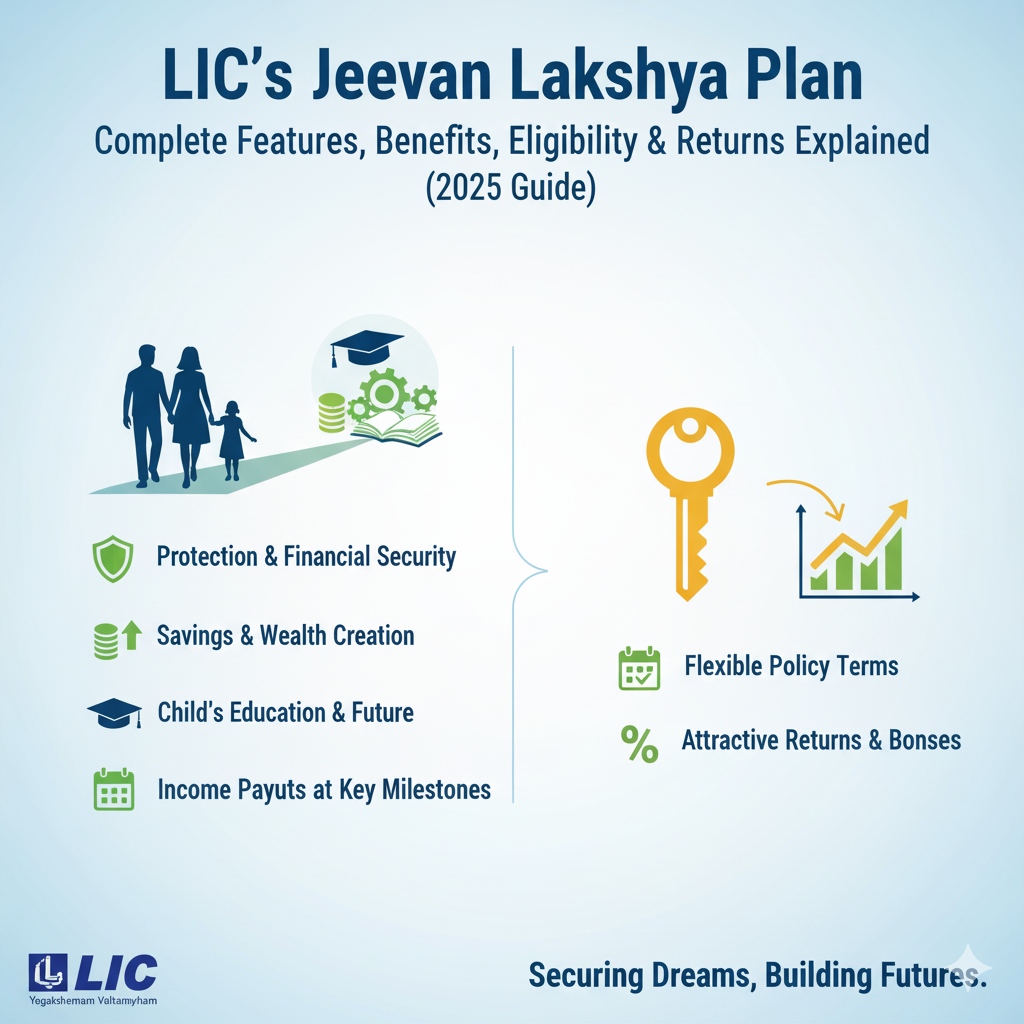

When it comes to protecting your family’s future, especially your children’s education and long-term needs, LIC’s Jeevan Lakshya plan stands out as one of the most trusted options. It beautifully combines life protection, annual income for dependents, and maturity savings, making it a smart family-oriented insurance plan.

In this blog, we break down LIC’s Jeevan Lakshya (UIN: 512N297V02) in simple language—its benefits, maturity returns, riders, surrender value, loans, and everything you need to know before buying.

What is LIC’s Jeevan Lakshya Plan?

LIC’s Jeevan Lakshya is a non-linked, participating, individual life assurance savings plan.

This simply means:

- ✔️ Your money is not linked to the share market

- ✔️ You get bonuses declared by LIC

- ✔️ Your family gets financial protection through a powerful death benefit

- ✔️ You also receive savings at maturity

The most unique feature of this plan is its Annual Income Benefit, which supports your family every year if something happens to you during the policy term.

Key Highlight – Annual Income Benefit for Your Family

If the policyholder dies before the policy matures:

👉 The family receives 10% of Basic Sum Assured every year as income

👉 A lump sum amount is paid on the maturity date

👉 All vested bonuses & final additional bonus (FAB) are paid on maturity

This ensures your family has continuous income + a big amount at maturity.

Benefits of LIC’s Jeevan Lakshya

1. Death Benefit (Strong Family Protection)

If the policyholder dies during the policy term and premiums are paid, the nominee gets:

A) Annual Income Benefit

- 10% of Basic Sum Assured every year from the next policy anniversary till one year before maturity.

B) Lump Sum at Maturity

- 110% of Basic Sum Assured paid on the maturity date.

C) Bonuses

- Full vested Simple Reversionary Bonuses

- Final Additional Bonus (if declared)

Minimum Guarantee

Death benefit will never be less than 105% of total premiums paid (excluding taxes/rider premiums).

2. Maturity Benefit (Guaranteed Savings + Bonuses)

If the policyholder survives till maturity:

- Sum Assured on Maturity = Basic Sum Assured

- + Vested Simple Reversionary Bonuses

- + Final Additional Bonus (FAB)

This provides a handsome lump sum for future goals such as retirement, children’s weddings, or long-term savings.

3. Participation in Profits (Bonuses)

Being a participating plan, Jeevan Lakshya earns:

- Simple Reversionary Bonuses (added every year)

- Final Additional Bonus (paid at maturity or death maturity payout)

Bonuses depend on LIC’s performance but historically LIC has offered stable returns.

Eligibility & Policy Conditions

| Feature | Details |

|---|---|

| Minimum Basic Sum Assured | ₹1,00,000 |

| Maximum Sum Assured | No limit |

| Policy Term | 13 to 25 years |

| Premium Paying Term | Policy Term – 3 |

| Minimum Entry Age | 18 years |

| Maximum Entry Age | 50 years |

| Maximum Maturity Age | 65 years |

Premium can be paid yearly, half-yearly, quarterly, or monthly (NACH).

Optional Rider Benefits Available

You can add up to 3 riders for extra protection:

🔹 Accidental Death & Disability Benefit Rider

Lump sum on accidental death + monthly installments in case of disability + premium waiver.

🔹 Accident Benefit Rider

Additional lump sum on accidental death.

🔹 New Term Assurance Rider

Extra pure life cover (available only at inception).

🔹 New Critical Illness Rider

Payout on diagnosis of 15 listed critical illnesses.

Each rider sum assured cannot exceed Basic Sum Assured.

Payment Options for Benefits

1. Death Benefit in Installments

Nominee can take lump sum OR receive it in installments over:

- 5 years

- 10 years

- 15 years

Minimum installment:

- ₹5,000 monthly

- ₹15,000 quarterly

- ₹25,000 half-yearly

- ₹50,000 yearly

2. Settlement Option (Maturity Benefit in Installments)

Policyholder can choose to receive maturity amount in installments (same durations as above).

This must be chosen 3 months before maturity.

Premium Examples (for ₹1,00,000 Sum Assured)

Age 20

- 13-year term → ₹9,873

- 15-year term → ₹8,114

- 20-year term → ₹5,645

- 25-year term → ₹4,253

Age 30

- 13-year term → ₹9,918

- 15-year term → ₹8,163

- 20-year term → ₹5,718

- 25-year term → ₹4,366

(Premiums are before GST)

Rebates / Discounts

Mode Rebates

- Yearly: 2% off premium

- Half-yearly: 1% off premium

- Quarterly / Monthly: NIL

High Sum Assured Rebates

- ₹2,00,000 – ₹4,90,000 → 2% of BSA

- ₹5,00,000 & above → 3% of BSA

Policy Loan Facility

Loan available after 2 full years of premium.

- 90% of surrender value (in-force policies)

- 80% of surrender value (paid-up policies)

Outstanding loan + interest is deducted from claim proceeds.

Surrender & Paid-Up Rules

Surrender

Allowed after 2 years’ premiums are paid.

You receive higher of Guaranteed Surrender Value (GSV) or Special Surrender Value (SSV).

Paid-Up

If premiums stop after 2 years:

- Policy continues as reduced paid-up

- Annual income & maturity amounts reduce proportionately

- No future bonuses

- Existing bonuses remain attached

Suicide Clause, Taxes & Free Look

- Suicide within 12 months → Limited benefit (as per LIC rules)

- GST/taxes apply on premiums

- Free-look period: 15 days from receiving policy bond

Who Should Buy Jeevan Lakshya?

This plan is ideal for:

✔️ Parents who want income protection for their children

✔️ Anyone who wants guaranteed protection + savings

✔️ People looking for bonus-earning traditional plans

✔️ Those wanting a disciplined long-term insurance plan

Pros & Cons

Pros

- Annual income support for dependents

- Guaranteed maturity benefit

- Bonus earning plan

- Loan and installment options

- Ideal for child financial security

Cons

- Returns are moderate (not market-linked)

- Low liquidity in early years

- Bonuses depend on LIC performance

Conclusion

LIC’s Jeevan Lakshya is one of LIC’s strongest family-oriented plans.

It ensures regular yearly income + maturity lump sum + bonuses, making it perfect for creating financial security for children and dependents.

If you want a long-term plan that gives both protection and savings, this is a highly reliable choice backed by LIC’s trust.

Ready to Buy LIC’s Jeevan Lakshya? (CTA)

Get a personalised premium quote and benefit illustration today.

📞 Call/WhatsApp: +91 9419797242

💬 Free guidance on choosing sum assured, riders, and policy term.