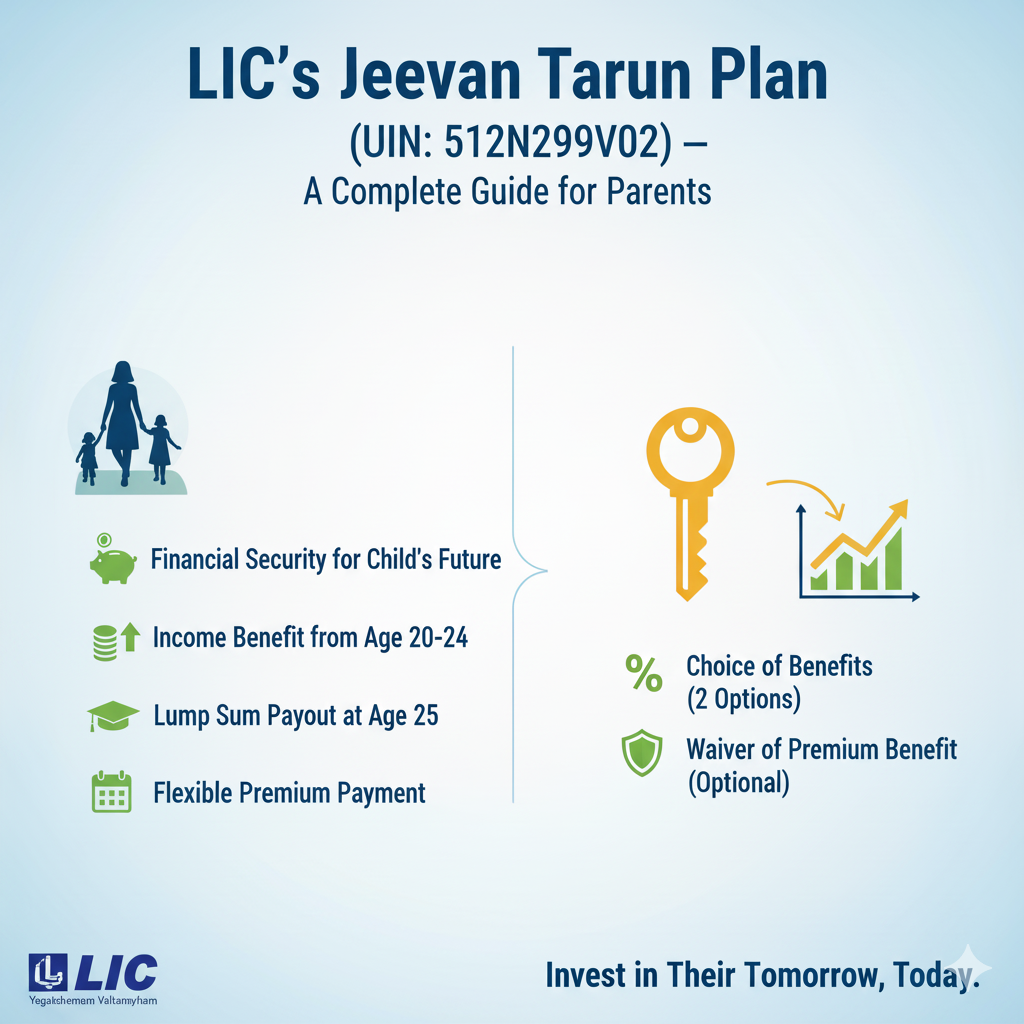

LIC’s Jeevan Tarun is a participating child savings plan that pays survival benefits at ages 20–24 and a lump sum at age 25. Read this clear guide to features, benefits, eligibility, premiums, surrender rules and how to choose the right option.

TL;DR

LIC’s Jeevan Tarun is a non-linked, participating life assurance savings plan for children. Parents or grandparents can buy it for a child aged 90 days to 12 years. At proposal stage you select one of four payout options that decide how much the child receives as annual survival payments (ages 20–24) and how much as maturity benefit at age 25. The plan also participates in LIC bonuses and offers rider, loan, surrender and paid-up features.

What is Jeevan Tarun?

Jeevan Tarun is designed to meet a child’s future needs — higher education, career start, marriage or other early-adult expenses. The plan gives you flexible distribution of benefits: small annual payments when the child reaches 20–24 years, and a lump sum at 25. Being a participating plan, it also gets simple reversionary bonuses and possibly a final additional bonus (subject to LIC declarations).

Payout Options (choose at proposal stage)

You must choose one option at the time of buying; it becomes part of the contract and cannot be changed later.

- Option 1: No survival benefit → 100% of Sum Assured at age 25.

- Option 2: 5% of Sum Assured each year at ages 20–24 (5 payments) → 75% of Sum Assured at maturity.

- Option 3: 10% each year at ages 20–24 → 50% at maturity.

- Option 4: 15% each year at ages 20–24 → 25% at maturity.

Example: Sum Assured = ₹1,00,000, Option 3 → Child receives ₹10,000 at ages 20,21,22,23,24 and ₹50,000 at 25 (plus vested bonuses if any).

Key Benefits

1. Death Benefit

- If death occurs after commencement of risk while the policy is in force, nominee gets:

Higher of (7 × annualised premium) OR (125% of Sum Assured) + vested bonuses + final additional bonus (if any). - Minimum death payout is 105% of total premiums paid (excl. taxes & rider premiums).

- If death occurs before commencement of risk, premiums paid (excl. taxes, extra/rider premiums) are refunded.

2. Survival Benefit

- Fixed percentage of Sum Assured (as per chosen option) is paid annually on the policy anniversaries coinciding with or following the child’s 20th birthday for five years (ages 20–24).

3. Maturity Benefit

- At age 25, the balance percentage of Sum Assured (as per option) plus vested bonuses and final additional bonus (if any) is paid.

4. Bonuses (Participation in profits)

- The plan participates in LIC profits via simple reversionary bonuses and may get a final additional bonus in the year of claim/maturity. Bonuses are not guaranteed.

Eligibility & Important Details

- Minimum Sum Assured: ₹75,000

- Maximum Sum Assured: No limit

- Entry age of child: 90 days to 12 years (last birthday)

- Maturity age: 25 years (policy term = 25 − age at entry)

- Premium Paying Term (PPT): 20 − age at entry

- Risk commencement:

- If child < 8 years: risk starts either one day before completion of 2 years from policy start or one day before the policy anniversary coinciding with/after age 8 — whichever is earlier.

- If child ≥ 8 years: risk starts immediately on issuance.

- Vesting: For minors, policy vests in the child on the policy anniversary coinciding with or following completion of age 18.

Riders & Optional Features

- LIC Premium Waiver Benefit Rider (UIN: 512B204V03) — on death of the proposer (usually parent), future base policy premiums are waived for the rider term. Rider premium ≤ 30% of base premium.

- Death benefit instalments & Settlement option: Death lump sum (or maturity) can be taken as instalments over 5 / 10 / 15 years with minimum instalment amounts (Monthly ₹5,000; Quarterly ₹15,000; Half-yearly ₹25,000; Yearly ₹50,000). If chosen net amount too small to meet minimum, proceeds paid as lump sum. Settlement option for maturity must be chosen at least 3 months before maturity.

Premiums — Sample (Sum Assured ₹1,00,000, standard lives; excl. taxes)

- Age 0: Option1 ₹4,390 | Option2 ₹4,488 | Option3 ₹4,586 | Option4 ₹4,684

- Age 4: ₹5,483 | ₹5,635 | ₹5,782 | ₹5,934

- Age 8: ₹7,414 | ₹7,644 | ₹7,879 | ₹8,109

- Age 12: ₹11,045 | ₹11,432 | ₹11,819 | ₹12,211

(Always request a current personalised illustration from LIC — rates change over time.)

Grace Period, Revival, Paid-Up & Surrender

- Grace period: 30 days (yearly/half-yearly/quarterly), 15 days (monthly). Cover continues during grace.

- Revival: Lapsed policy can be revived within 5 consecutive years from the date of first unpaid premium by paying arrears + interest and satisfying underwriting. Rider revival follows base policy.

- Paid-up: If ≥ 2 years premiums paid and subsequent premiums stop, policy becomes paid-up; benefits reduce proportionately; no future bonuses; vested bonuses remain payable at maturity. Under paid-up, no future survival benefits are payable.

- Surrender: Allowed after 2 full years’ premiums. Surrender value = higher of Guaranteed Surrender Value (GSV) or Special Surrender Value (SSV). Survival benefits already paid are deducted where applicable.

Policy Loan & Taxes

- Loan: After 2 full years’ premiums — up to 90% of surrender value for in-force policies and 80% for paid-up policies. Interest and other terms as declared by LIC. Outstanding loan + interest recovered from claim proceeds.

- Taxes: Statutory taxes (GST) on premium are payable by policyholder and excluded from benefit calculations. Consult your tax advisor for impact.

Suicide Clause & Free-Look Period

- Suicide exclusion: If suicide occurs within 12 months of commencement of risk (or within 12 months of revival), limited payout rules apply (generally 80% of premiums paid or surrender value); some exceptions for minors and revival cases apply — see policy wording.

- Free look: Policy can be returned within 15 days of receipt for cancellation and refund (subject to deductions).

Pros & Cons

Pros

- Specifically designed for children’s education and early adult needs.

- Flexible payout options to match your financial planning.

- Participates in LIC bonuses and provides security of a traditional product.

- Useful premium-waiver rider to protect the plan if proposer dies.

Cons

- Bonuses are not guaranteed — returns depend on LIC’s future declarations.

- Limited liquidity in early years; survival payments start only at age 20.

- Market-linked instruments may outperform in growth if you accept higher volatility.

Who Should Buy Jeevan Tarun?

- Parents or grandparents who want a goal-oriented, low-risk savings plan for a child’s higher studies or early adult expenses.

- Families that prefer certainty, gradual payouts and the safety of an LIC participating product.

- Not ideal if you need early liquidity or prefer aggressive, market-linked growth before the child turns 20.

Final Thoughts

Jeevan Tarun is a simple, reliable and flexible solution for building a secure corpus for a child’s formative financial needs. By choosing the right option (1–4) you can balance between regular survival payouts during early adulthood and a larger lump sum at age 25.

Ready-to-use CTA

📞 Call/WhatsApp: